¿QUÉ ES UGT FICA

UGT FICA es una federación del sindicato UGT en España que agrupa a trabajadores de la industria, la construcción y la agricultura. Se encarga de defender sus derechos laborales, negociar mejores condiciones de trabajo y asegurarse de que estén seguros en sus empleos. Básicamente, es como su respaldo en el trabajo para que todo vaya mejor.

NOTICIAS

Mariano Hoya denuncia la persecución inaceptable de sindicalistas panameños ante la Embajada de Panamá

Una representación de UGT FICA se ha concentrado hoy para exigir l...

Leer más

Seguimiento también masivo en la segunda jornada de huelga en Fertiberia

UGT FICA reitera que no va a permitir despidos injustificados ni r...

Leer más

Seguimiento mayoritario en la huelga histórica en Iberdrola

UGT FICA exige recuperar el poder adquisitivo perdido, incrementos...

Leer másUGT FICA Sevilla se moviliza ante AIRBUS para exigir el fin de la persecución sindical en SOFITEC, su proveedor principal en la provincia

En las últimas semanas, la empresa proveedora ha despedido al delegado de prevención que interpuso...

El segundo día de huelga general en el metal de Cantabria supera el seguimiento del primero y alcanza el 95%

UGT FICA, CCOO y USO insisten en que la negociación de este viernes "es muy decisiva" porque...

UGT FICA llama a concentrarse mañana ante la Embajada de Panamá en protesta por la persecución y acoso sindical

Mariano Hoya y Sergio Estela, que van a participar en el acto, exigen la liberación inmediata de...

UGT FICA Catalunya valora positivamente el preacuerdo del ERE en el Grupo Freixenet, que prioriza la voluntariedad en las salidas

El principio de acuerdo, ratificado por las asambleas de trabajadores y trabajadoras, reduce la...

UGT FICA participa en la reunión de hoy de la Comisión Consultiva de las Transformaciones Industriales

Se ha debatido sobre el contenido del documento "Hacia una estrategia de Preparación de la Unión",...

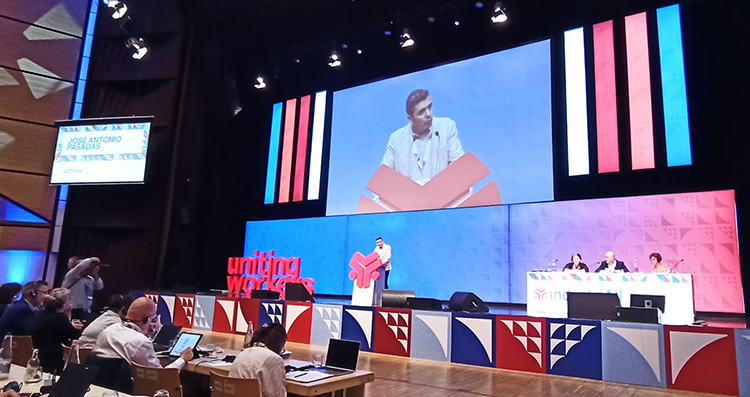

Mariano Hoya interviene en el 4º Congreso de IndustriALL Europa

El secretario general de UGT FICA ha alertado sobre las dificultades que atraviesan los sectores...

José Antonio Pasadas reclama más negociación colectiva y más diálogo social para luchar contra la ola de ultraderecha

El secretario de Acción Sindical de UGT FICA ha intervenido hoy en el 4º Congreso de IndustriALL...

Sin acuerdo en la negociación en el SIMA del Convenio Estatal de Productos Elaborados del Mar

La patronal sigue bloqueando la posibilidad de avanzar en las negociaciones por su oposición a la...

Los trabajadores y trabajadoras de Fertiberia van a la huelga durante cinco días

En la reunión de esta mañana, UGT FICA ha exigido a la Dirección la retirada del expediente de...

UGT FICA reclama, una vez más, la presencia de los sindicatos en el Consejo Agrario

La Federación celebra la constitución del nuevo órgano, pero rechaza la exclusión de los...

El 90% de los trabajadores secunda por ahora la huelga del metal en Cantabria

En protesta por la absoluta falta de voluntad negociadora de la patronal Pymetal. La huelga se...

Los trabajadores y trabajadoras de Iberdrola van a la huelga este viernes

Alrededor de 9000 personas trabajadoras del Grupo están convocadas a secundar la movilización en...